S2K/Miller CLT DST

4.8-acre Delaware Statutory Trust investment on our core NoDa parcel in Charlotte, NC.

S2K/Miller CLT DST

4.8-acre Delaware Statutory Trust investment on our core NoDa parcel in Charlotte, NC.

Investment Overview

Passive DST Vehicle

on Prime Charlotte Parcel

The fund offers accredited investors access to a stable, income-oriented real estate investment in one of Charlotte’s most dynamic growth corridors.

Structured as a Delaware Statutory Trust (DST), the offering enables passive ownership of a fully entitled land asset, with income paid via a pre-funded master lease.

-

Annual Lease Payment Structure

Master Tenant pays an annual lease amount equal to 7% of offering amount, then used to make monthly DST income distributions1

1) Distributions are not guaranteed and may include return of principal -

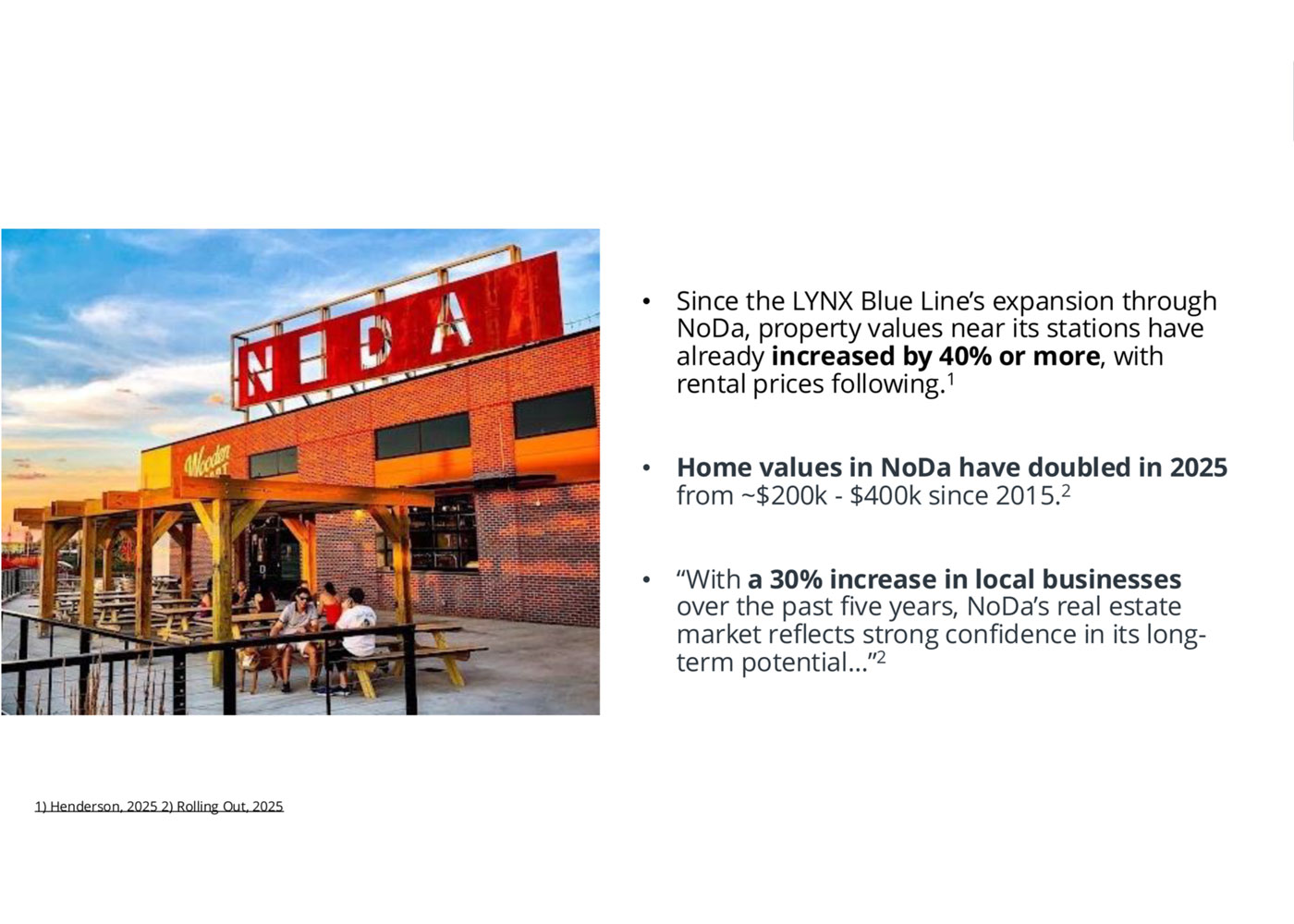

Prime NoDa Location

Located on 4.8-acre parcel near our future multifamily and mixed-use development in progress.

-

Passive Real Estate Ownership

Simplified tax reporting (1099) and eligibility for 1031 exchanges, with no development risk.

-

Pre-Development Positioning

~ $1.9M committed to horizontal site improvements (roads, utilities, essential infrastructure).

-

Long-Term Optionality

Sponsor maintains the right to repurchase the land at then-current fair market value.

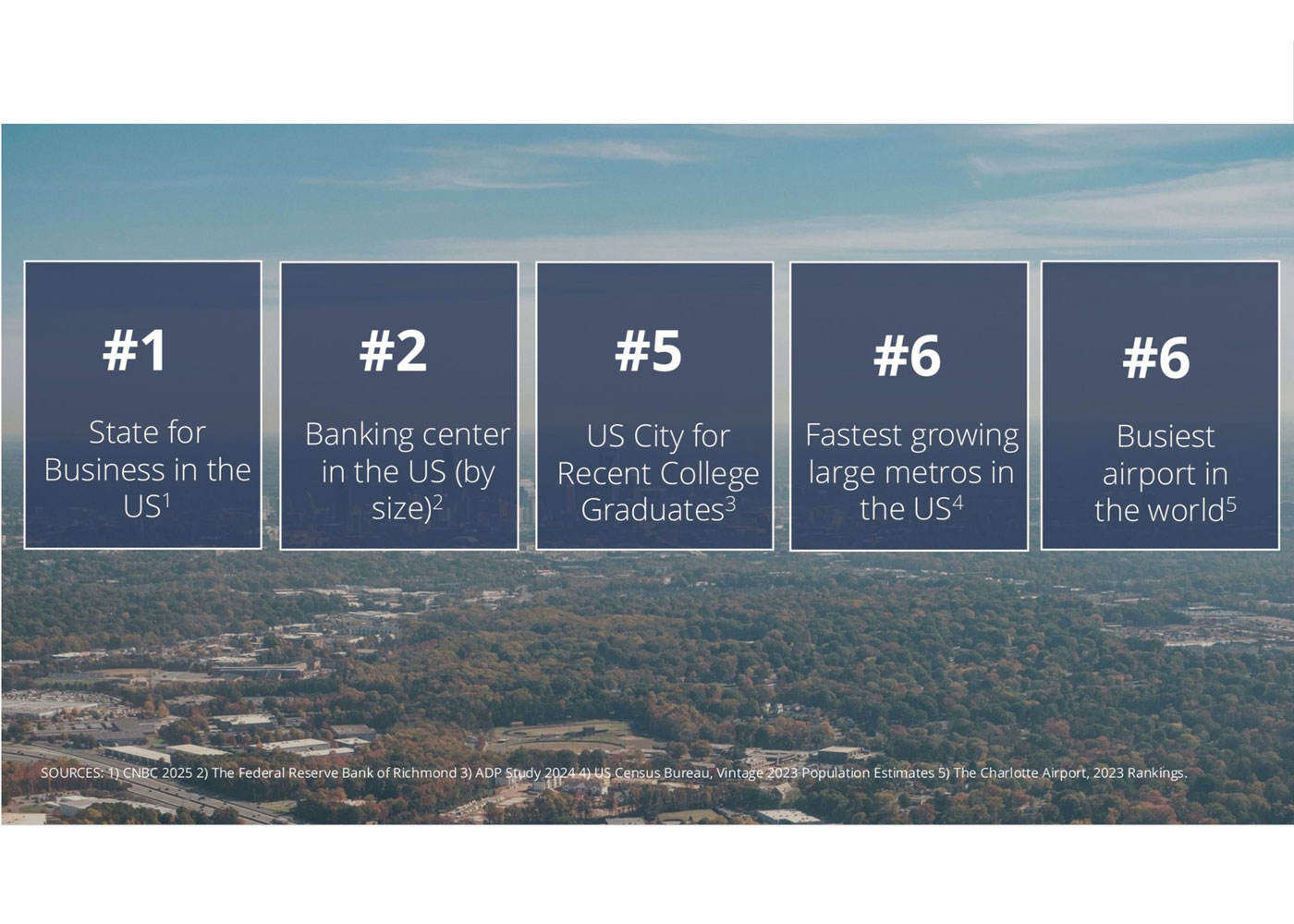

#1 Best State for Business, #1 Housing Market

Highly Desirable Location

- Fully entitled line with most flexible TOD-CC zoning designation

- 5-minute walk from northern light rail spur

- 17 minutes from Charlotte Douglas International Airport

- 12 minutes from UNC Charlotte

- 10 minutes from central business district

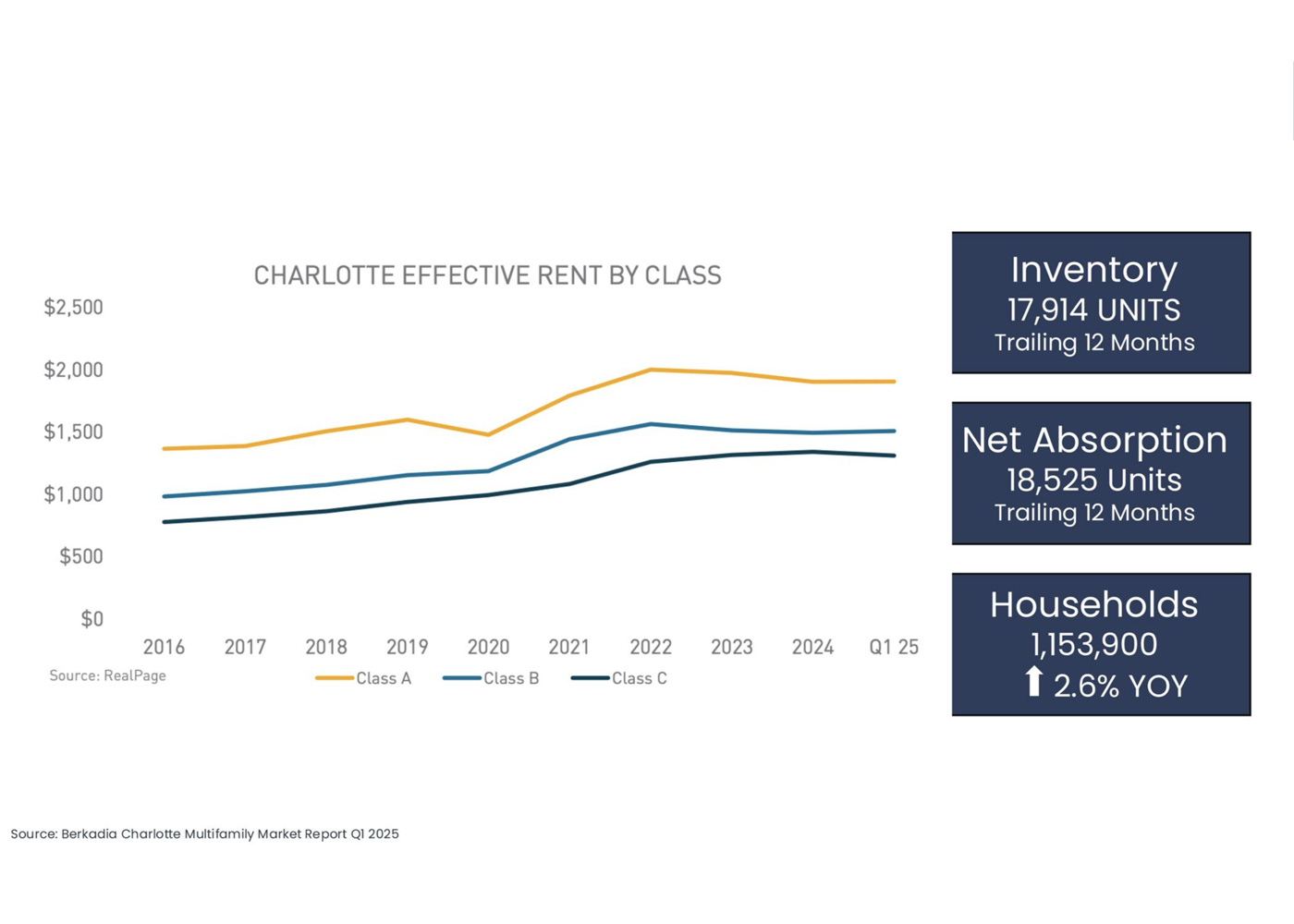

- NoDa submarket projects highest overall household and income growth rates through 2027

- Site part of NC Brownfield Program

One of the Fastest Growing Markets

- #1 State for Business in the US1

- #2 Banking center in the US (by size)2

- #5 US City for Recent College Graduates3

- #6 Fastest growing large metros in the US4

- #6 Busiest airport in the world5

1) CNBC 2025 2) The Federal Reserve Bank of Richmond 3) ADP Study 2024 4) US Census Bureau, Vintage 2023 Population Estimates 5) The Charlotte Airport, 2023 Rankings.

What is a Delaware Statutory Trust (DST)?

How a DST Works

A Delaware Statutory Trust (DST) is a legal structure that allows multiple investors to co-own a single real estate asset without active management responsibilities.

Each investor holds a fractional interest in the trust, which owns the property outright. The DST acts as the passive titleholder, while daily operations are handled by a professional sponsor or trustee.

DSTs are governed by strict IRS rules that prohibit refinancing, redevelopment, or active control—ensuring the investment remains hands-off and income-generating.

This structure is often used for stabilized, cash-flowing assets or ground-leased land, making it an appealing option for investors seeking passive real estate exposure with predictable income streams.

DSTs & 1031 Exchanges

DSTs are a popular replacement option in 1031 exchanges as a streamlined way to defer capital gains tax when selling appreciated real estate.

Because a DST qualifies as “like-kind” property, investors can reinvest their sale proceeds into a DST to continue tax deferral—without needing to manage a new property.

Income is typically distributed monthly or quarterly from rents or ground lease payments. For investors seeking to exit active ownership (such as landlords, developers, or aging investors), DSTs provide a fully passive and tax efficient solution for access to institutional-grade real estate.

Who Can Invest & How to Evaluate DSTs

DSTs are open to accredited investors only, as defined by SEC regulations. They’re best suited for those seeking passive income, tax deferral via 1031 exchange, or diversification across property types and geographies.

When evaluating a DST, consider:

- the underlying asset quality and location

- the sponsor’s track record

- the lease structure—especially whether payments are backed by credit, cash reserves, or operating income

Investors should also understand liquidity limitations and exit scenarios, as DSTs are long-term holdings with minimal flexibility once subscribed.

Invest Side-by-Side with Real Estate Industry Veterans

The complementary skill sets and experience of the Fund managers are one of the Fund's greatest assets. This team has led and founded multiple prior institutional lending platforms over 40 years of real estate investing, resulting in deep real estate capital market relationships and in-house capital-raising talent and network. In fact, since 1996*, 78% of this team's deals (by count) have been sourced "off-market."

With an in-house development team, affiliated property manager, and an institutional reporting and asset-management platform, this vertically integrated team is prepared to deliver quality, performance, and in-depth investor service and support.

* There can be no guarantee that prior off-market sourcing track record predicts future performance.

FAQ

There is no established secondary market for the Fund’s beneficial interests, and none is expected to develop. Interests in the DST are subject to substantial transfer restrictions. Accordingly, investors should be prepared to hold their investment for an indefinite period of time, unless and until a liquidity event is initiated by the sponsor.

Distributions are expected to be made monthly and are funded through a master lease agreement in which the property is leased to a sponsor-controlled tenant at a fixed 7% return. Lease payments will initially be supported by pre-funded reserves. The DST may also use proceeds from operations, future leases, or other capital sources. Distributions are not guaranteed and may vary depending on cash flow and reserve availability.

This is a 506(c) offering available to accredited investors only. Please visit our investor portal to confirm eligibility and review offering documents.

4109 Greensboro St, Charlotte

As a DST, this offering does not include direct ownership or development of an apartment complex. The DST owns the land and leases it via a long-term ground lease. While future development may occur if the sponsor exercises its call option to reacquire the land, this investment does not participate in that vertical development or any related amenities.

- Sponsor: S2K Financial & Miller Properties

- Legal Counsel: Polsinelli LLP

- Master Tenant: An affiliate of the sponsor

- Transfer Agent: Vistra USA LLC

Investing in the Fund is highly speculative and involves a high degree of risk. You should consider purchasing interests only if you can afford a complete loss of your investment. Please carefully review the full section entitled “Certain Risk Factors” in the Fund’s Private Placement Memorandum (“PPM”) before investing. A summary of key risks includes, but is not limited to, the following:

- Illiquidity and Lack of Transferability: Interests in the DST are illiquid and not expected to be resold. There is no secondary market, and investors should expect to hold the investment indefinitely. Restrictions on transfers also limit the ability to exit early or reposition capital.

- DST Structural Constraints: DSTs are governed by IRS regulations that restrict the ability to refinance, redevelop, or materially improve the property. These limits prevent active asset management and may impact the ability to respond to market conditions or maximize property value.

- Reliance on Master Lease Payments: All investor distributions are dependent on the master tenant fulfilling lease obligations. Although reserves are pre-funded, if the master tenant defaults or becomes financially impaired, the DST may be unable to make scheduled distributions.

- Sponsor Call Option: The sponsor has the right to reacquire the land. While this feature may enable future development upside, the timing, pricing, and structure of the call option may not align with investor liquidity preferences or desired holding periods. Investors have limited control over exit mechanics.

- Real Estate Market Risks: The performance of the land parcel is subject to broader macroeconomic conditions, including fluctuations in interest rates, property valuations, inflation, and local market demand. Economic downturns, regulatory changes, or declining demand in the Charlotte NoDa submarket could adversely affect the investment.

- Use of Offering Proceeds and Reserve Depletion: The Fund may use offering proceeds to fund distributions or lease reserves. If these reserves are depleted before income stabilizes, future distributions may be delayed or reduced. Investors should not assume that yield targets are guaranteed or reflective of long-term operational performance.

- Dependence on Sponsor and Affiliates: The master tenant and administrative entities are controlled by the sponsor and its affiliates. Conflicts of interest may arise, and there is no assurance that transactions between affiliated parties will be conducted at arm’s length or in favor of the DST’s investors.

- Limited Operating History: The DST is a newly formed entity with no historical performance, and past success of the sponsor is not a predictor of future results. Unforeseen legal, tax, or operational issues may arise during the investment term.

These and other risks should be thoroughly reviewed with a qualified advisor. Investing in DST structures is not suitable for all investors and may not align with short-term cash flow or liquidity objectives. Please consult the Fund's PPM for additional detail on structure-specific and project-specific risk disclosures.

Terms

DST Interests

S2K | Miller CLT DST

$23M

No Debt at DST (Debt is Level Above)

2–3 Years

Accredited Investors

$100,000

Vistra USA LLC

Forvis Mazars LLP

Polsinelli PC

This DST complements other active offerings across the subdivided NoDa site:

Important Information

THIS MATERIAL IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY SECURITIES. THE OFFERING AND SALE OF INTERESTS IN S2K/MILLER CLT DST (“THE DST”) IS BEING MADE ONLY BY DELIVERY OF THE DST’S PRIVATE PLACEMENT MEMORANDUM (“PPM”), CERTAIN ORGANIZATIONAL DOCUMENTS, SUBSCRIPTION AGREEMENT AND CERTAIN OTHER INFORMATION TO BE MADE AVAILABLE TO INVESTORS (“OPERATIVE DOCUMENTS”) BY THE DST’S SPONSOR. This material must be read in conjunction with the Operative Documents in order to fully understand all of the implications and risks of the offering of securities to which the Operative Documents relate. Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of the DST’s interests, determined if the Operative Documents are truthful or complete or passed on or endorsed the merits of the offering. Any representation to the contrary is a criminal offense. You may only invest in the DST if you are an accredited investor as defined in Rule 501 of Regulation D.

Investing in the DST will involve significant risks, including possible loss of your entire investment. An investment in the DST will be illiquid, as there is no secondary market for the DST’s interests, and none is expected to develop; and there will be substantial restrictions on transferring such interests. Accordingly, an investor may be required to maintain its interest in the DST for an indefinite period of time. See the section entitled “Certain Risk Factors” of the DST’s PPM to read about the more significant risks you should consider before investing. As a result, returns to investors could be materially reduced. Investors should have the financial ability and willingness to accept the risk characteristics of the DST. Prospective investors should make their own investigations and evaluations of the information contained in this material and the other Operative Documents.

Investors should not construe the contents of this presentation as legal, tax, accounting, investment or other advice. Each investor should make its own inquiries and consult its advisors as to legal, tax, financial, and other relevant matters concerning any investment, including an investment in the DST. The indicative terms and other information included in this presentation are incomplete, subject to change and are provided for discussion purposes only. Please refer to the PPM and the Operative Documents for a detailed description of the terms of the DST. This material does not take into account the particular investment objectives or financial circumstances of any specific person who may receive it. An investment in the DST is not suitable for all investors. This presentation and related information about the DST cannot be used in conjunction with the marketing of any product or security. Recipients should not rely on this presentation in making any future investment decision.

Risk Factors

SUMMARY OF KEY RISK FACTORS

Risks of an investment in the DST include, among other things, the following:

• Complete reliance on the Master Tenant to pay the rent and perform its obligations under the Master Lease;

• Limited control over the property and day-to-day operations by investors;

• Lack of liquidity, as there is no established secondary market for interests in the DST and transfers are restricted;

• Holding a beneficial interest in the DST without any voting rights;

• The long-term nature of the Master Lease, which may limit flexibility in responding to market conditions;

• Limited diversification, as the DST’s performance depends on a single property;

• Various conflicts of interest among the Sponsor, the DST, the Master Tenant, and their affiliates;

• Various risks associated with real estate generally and specifically with ownership of vacant land;

• Certain tax risks, including the potential loss of anticipated 1031 exchange benefits if the DST fails to qualify; and

• Changes in interest rate levels and volatility in the capital markets, which could adversely affect property values.

Investors should carefully review the “Certain Risk Factors” section of the Private Placement Memorandum for a more complete discussion of these and other risks before making an investment decision.

This material contains forward-looking statements within the meaning of federal securities laws and regulations relating to the business and financial outlook of the DST that are based on management’s current expectations, estimates, forecasts and projections and are not guarantees of future performance. These forward-looking statements are identified by the use of terms and phrases such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will” and other similar terms and phrases, including references to assumptions and forecasts of future results. Actual results may differ materially from those expressed in these forward-looking statements. You should not place undue reliance on any such statements. A number of important factors could cause actual results to differ materially from the forward-looking statements contained in this material. Forward-looking statements in this material speak only as of the date on which such statements were made and not as of any future date, and the DST undertakes no obligation to update any such statements that may become untrue because of subsequent events.

Securities offered through S2K Financial LLC, member FINRA/SIPC, the dealer manager for S2K/Miller CLT DST.