S2K Miller Fund LP

Participate in the 10th Commercial Real Estate Fund sponsored by Miller Properties Group

S2K/Miller Real Estate Fund

Participate in the 10th Commercial Real Estate Fund sponsored by Miller Properties Group

Significant Potential for Enhanced Returns

With over 100+ years of combined real estate investment experience, the S2K Miller Fund will focus on investing (directly or with asset-specialist Co-GP Partners) in real estate opportunities focusing on situations where the property provides a "roof over head" solution to its users and tenants.

The Fund seeks joint-venture Limited Partners (LPs) to fund up to +/- 90% of deal equity, providing an opportunity for scaled buying power and enhanced economics.

Turning $100 million into ~$2.5 billion

- Raise $100 million in equity, anticipated to invest in approximately $2.5 billion1 of assets providing potential for enhanced returns.

- Fund structured with 10% Preferred Return2.

- Investors share in 50% of all Fees and 100% of deal and Promote economics generated through the Fund's investment portfolio.

- Investments in 'under the radar' opportunities through development, value-add acquisitions, and lending strategies, often with joint venture investors.

- Led by real estate professionals with a combined 100+ years of real estate experience in investment, development, fund management, and lending.

1 Estimation by Fund Manager

2 Distributions are not guaranteed and may include return of principal, and in such cases, the Fund will have less money to invest, which may lower its overall return.

Acquisition Strategy

The fund will focus on investing (directly or with asset-specialist Co-GP Partners) in real estate opportunities focusing on situations where the property provides a "roof-over-head" solution to its users and tenants.

Apartments | Multifamily Residences | Hotels

Scaled Buying Power

The Fund will seek joint-venture Limited Partners to fund up to +/- 90% of deal equity, providing an opportunity for scaled buying power and enhanced economics.

Multiple Points of Leverage

Innovative Structure Increases Opportunities for Returns

- Innovative structure extends potential of investments.

- JV Partners at asset level is like an invitation to join the firm with multiple opportunities to leverage.

- Under-the-radar focus means this fund will pursue assets not actively sought by institutionally capitalized investors.

- Smaller transaction sizes attract less institutional attention and may offer better risk/reward than larger portfolios.

- Will develop assets in primary growth markets with high value/cost spread.

- Will acquire assets with attractive cost-basis to reposition in stable/recovering markets.

- Will opportunistically lend throughout capital stack to diversify portfolio risk profile and earn current returns.

S2K Dashboard: S2K/Miller Real Estate Fund

Invest Side-by-Side with Real Estate Industry Veterans

The complementary skill sets and experience of the Fund managers are one of the Fund's greatest assets. This team has led and founded multiple prior institutional lending platforms over 40 years of real estate investing, resulting in deep real estate capital market relationships and in-house capital-raising talent and network. In fact, since 1996*, 78% of this team's deals (by count) have been sourced "off-market."

With an in-house development team, affiliated property manager, and an institutional reporting and asset-management platform, this vertically integrated team is prepared to deliver quality, performance, and in-depth investor service and support.

* There can be no guarantee that prior off-market sourcing track record predicts future performance.

Development History

and Current Assets Map

This map shows just 84 of the properties the Miller team has developed in its history. Be sure to zoom in on urban areas - many properties are clustered close together and cannot be fully viewed in zoomed out mode.

-

S2K Miller - Current Assets

S2K Miller - Current Assets -

Miller Global

Miller Global -

Miller-Klutznick-Davis-Gray to Miller Davis

Miller-Klutznick-Davis-Gray to Miller Davis -

Rosenbaum & Miller through Urban Investment & Development Co.

Rosenbaum & Miller through Urban Investment & Development Co.

Stonecreek I and II

Park at Northwest Point II

Hilton Canopy Scottsdale

1001 17th Street

1001 17th Street, Denver

4600 S. Syracuse

116 Inverness

1155 Island Avenue

1333 H Street

18 Gramercy Park South

1900 West Loop South

7 Oaks East

7 Oaks West

875 Third Avenue

gNorth

Alamo Plaza

The Algonquin Hotel

The Canyon at Wild Basin

Capital Ridge

Cascade Yard

Crescent V

Crescent VI

Cyprus Land

Dry Creek Centre

Dulles Executive Center I and II

The Ellipse at Ballston

Embassy Suites Springfield at Fort Belvoir

Fairway Corporate Center

Harborview

HIW: 4101 Research Commons

HIW: 4201 Research Commons

HIW: 4301 Research Commons

HIW 4501 Research Commons

HIW Anchor Glass

HIW: Bayshore Place

HIW: Capital Plaza I

HIW Capital Plaza II

HIW: The Concourse

HIW: Deeerfield I and II

HIW: Lake Plaza East

HIW: Landmark I and II

HIW: Peachtree Corners I and II

HIW: Signature Plaza

HIW: Situs I and II

HIW: Tower Place

JW Marriott San Antonio Hill Country Resort & Spa

King Street Station III

Metro Center I and Land

Metropoint I and II

Nickelodeon Suites Resort

North Scottsdale Corporate Center I

North Scottsdale Corporate Center II

Northwest Point Land

Ocean Ridge

One DTC

Panorama Corporate Center

Park Ridge IV

Park Square

Pima Northgate

Rancho Bernardo

Residence Inn Alexandria Old Town

Residence Inn Bellevue Downtown

Residence Inn Old Town South at Carlyle

South Place

Stonecliff

Terrace Building

The Office at Park Ten

The Office at Park Ten

The Point at Inverness

Three Forest Plaza

Timberlake Crossing I, II and III

Waterview Land

Worldgate Plaza I, II, III and IV

Lincoln Center Office Building

Wells Fargo

Johns Manville Building

1801 California Tower

Pebble Beach Resort

Aspen Skiing Company

Fox Plaza (Die Hard's "Nakitomi Tower")

Water Garden Office Complex

Reston Town Center

Beverly Hills HOtel

75-101 Federal Street

Inn at Spanish Bay Resorts

FAQ

$5,000,000

Total Expected Fund Capital inclusive of Minimum Sponsor Investment (collectively “Investors” for purpose of Fund Waterfall defined herein). The minimum sponsor investment includes investments made by employees and friends and family of the sponsor.

Accredited Investor

$100,000

8 years from final closing, plus two one-year extensions

Year 1: $3M (only paid once aggregate capital contributions exceed $20M)

Year 2: $2M (only paid once aggregate capital contributions exceed $30M)

Year 3: $1M (only paid once aggregate capital contributions exceed $50M)

The yearly asset management fee accrues quarterly and will only be paid once aggregate capital contributions exceed the required amount. Any accrued asset management fees will be forfeited if the applicable threshold for payment has not been met by the final closing date.

- 100% of investment returns; 100% of investment promote;

- 50% of investment fees3

3Fees exclusive of property management fees

- Tier 1: 10% Preferred Return to Investors4

- Tier 2: Return of Capital to Investors

- Tier 3: 100% Catchup to Sponsor5

- Tier 4: 70/30% (Investors/Sponsor) until Investors have received a 15% IRR

- Tier 5: 50/50% split thereafter

4 Distributions are not guaranteed and may include return of principal, and in such cases, the Fund will have less money to invest, which may lower its overall return.

5 Until the Sponsor has received 30% of the aggregate amounts distributed in Tier 1 and Tier 3.

- Selling Commissions: 7% (does not apply to advisory accounts)

- Placement Agent Fee: 3%

Selling commissions and Placement Agent Fees, if any, are paid by Limited Partners and are charged in addition to a Limited Partner’s Capital Contributions in the Fund. Such amounts will not be deemed to be Capital Contributions for any purposes under the Partnership Agreement. The Placement Agent may waive or reduce the selling commissions and/or the Placement Agent Fee.

FAQ (cont)

Invest in "under-the-radar opportunities through development, value-add acquisitions, and lending strategies, often with joint venture investors

Fund structured with 10% Preferred Return6. Investors share in 50% of all fees and 100% of deal and promote economics generated through the Fund's investment portfolio.

6 Distribution are not guaranteed and may include return of principal, and in such cases, the Fund will have less money to invest, which may lower its overall return.

Raise $100 million in equity ("Fund") anticipated to invest in approximately $2.5 billion* of assets providing potential for enhanced returns.

*Estimation by Fund manager

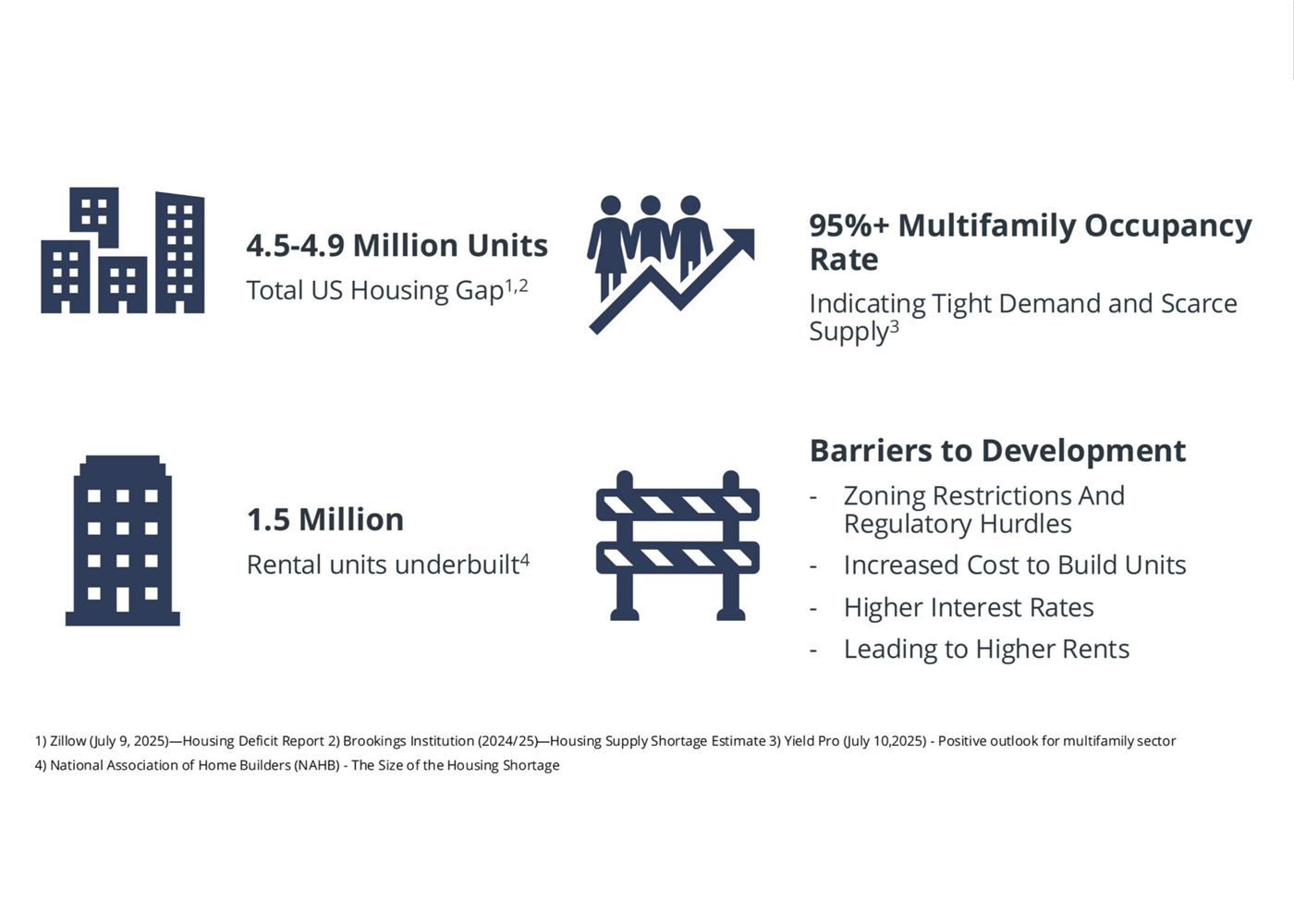

The Fund will focus on investments in housing, including multifamily, for-sale condominiums, adaptive reuse, single-family rental, manufactured housing, age-restricted (senior) housing, hotels, student housing, and other complementary and ancillary uses.

Smaller transaction sizes attract less institutional attention and may offer better risk/reward than larger portfolios.

The Fund will offer deal oversight from acquisition through disposition, including sourcing, underwriting and due diligence, asset management, and disposition.

Important Information

These materials (the “Materials”) and the information contained herein are strictly confidential and are being provided to you in a one-on-one presentation for informational and discussion purposes only. By acceptance of the Materials you agree to keep them confidential and not to disclose them to anyone except (i) to your legal, tax and financial advisors who agree to maintain the Materials in confidence or (ii) to a government official upon request, if entitled to such information pursuant to a judicial or governmental order.

Except as otherwise noted, the term “Manager" as used throughout this presentation refers collectively to Miller Properties Group and its affiliates (collectively, “Miller”) and S2K Asset Management and its affiliates (collectively, “S2K”, and together with Miller, “S2K/Miller”).

The Materials should not be photocopied, reproduced or delivered to any person without the prior permission of the Manager. Investors should not construe the contents of the Materials as legal, tax, accounting, investment or other advice. Each investor should make its own inquiries and consult its advisors as to legal, tax, financial, and other relevant matters concerning any investment, including an investment in the S2K-Miller Fund LP, a Delaware limited partnership (the “Fund”). The indicative terms and other information included in the Materials are incomplete, subject to change and are provided for discussion purposes only. Please refer to the Offering Memorandum of the Fund for a detailed description of the terms of the Fund.

S2K Financial LLC (“S2K Financial”), an affiliate of S2K, will serve as Placement Agent for the Fund. As Placement Agent, S2K Financial may receive selling commissions of up to 7.0% of the gross sales proceeds from investors that invest through participating broker-dealers, 100% of which will be reallowed by S2K Financial to participating broker-dealers. S2K Financial may also receive a placement agent fee equal to 3.0% of the gross sales proceeds from investors that invest through participating broker-dealers, registered investment advisors or family offices, all or a portion of which may be reallowed by S2K Financial to participating broker-dealers.

The Materials are not an offer to sell a security nor the solicitation of an offer to buy a security and no offer or solicitation should be implied by the delivery of the Materials. The Materials and related information about the Fund cannot be used in conjunction with the marketing of any product or security. Recipients should not rely on the Materials in making any future investment decision. Statements contained in the Materials are based on current expectations, estimates, targets, projections, opinions and beliefs of the Manager. Such statements involve known and unknown risks, uncertainties and other factors. These and other forward-looking statements contained in the Materials are speculative in nature, involve a number of assumptions which may not prove to be valid, and may be changed without notice. “Forward-looking statements” can be identified by the use of forward-looking terminology such as “may,” “will,” “seek,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” “target,” “plan” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements. No reliance may be placed for any purpose whatsoever on the information, representations or opinions contained in the Materials, and no liability is accepted for any such information, representations or opinions, nor does the Manager or any other person, to the maximum extent permitted by law, accept any responsibility or liability whatsoever for any direct or indirect loss howsoever arising from the use of the Materials.

Statements in the Materials are made as of July 2024, unless otherwise stated herein, and the delivery of the Materials shall not at any time under any circumstances create an implication that the information contained herein is correct as of any time subsequent to such date. The Manager does not have any obligation to update or revise any statement in the Materials or correct inaccuracies whether as a result of new information, future events or otherwise. The information contained herein has not been audited, contains approximates and has no bearing on the future performance of the Fund.

Performance Information. In considering any target, projected or historical performance information contained herein, prospective investors should bear in mind that such information is not necessarily indicative of future results. While the targeted or projected returns are based on assumptions regarding estimates of underlying cash flows, current business plans, timing, financing terms and residual values for the investments which the Manager believes are reasonable, there can be no assurance that such results will actually be realized or that capital contributed by investors will be returned. Actual gross and net returns for the Fund, and individual investors participating directly or indirectly in the Fund, may vary significantly from any targeted, projected or historical returns set forth herein and will depend on, among other factors, the ability to consummate attractive investments, future operating results, the availability and terms of financing, the value of the assets and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the assumptions on which the targeted or projected returns are based. Past performance of the Fund and other accounts managed by Miller, S2K, and their respective principals is no guarantee, and may not be indicative, of future results.

Information regarding expected market returns and market outlooks is based on research, analysis, and opinions of certain members of the Manager. These conclusions are speculative in nature, may not come to pass, and are not intended to predict the future of any specific investment. Certain factual economic and market information contained herein has been obtained from published sources prepared by other parties and has not been independently verified by the Manager. While such sources are believed to be reliable, the Manager does not assume any responsibility for the accuracy or completeness of such information.

Images contained herein are for illustrative purposes only.

Risk Factors

Investing in the Fund is highly speculative and involves a high degree of risk. You should purchase these interests only if you can afford a complete loss of your investment. See the section entitled “Certain Risk Factors” of the Fund’s private placement memorandum (“PPM”) to read about the more significant risks you should consider before investing. These risks include the following:

- It is expected that the substantial majority of the Fund’s portfolio of investments will consist of real estate assets that are illiquid or for which a secondary market is not readily available. Such illiquidity may limit the Fund’s ability to modify its portfolio in response to changes in economic or other conditions.

- The Fund intends to obtain additional equity capital from other limited partners for the majority of its investments and may not be successful. Many variables exist regarding the ability to consummate a transaction with such limited partners. As a result, the Fund may experience longer times than expected to raise capital which may preclude the

acquisition of an investment or extend the time an asset is owned, which may reduce the expected return to the Fund. - The acquisition, rehabilitation, renovation and development of the Fund’s investments may be financed in substantial part by debt, which will increase the Fund’s exposure to loss. The use of leverage involves a high degree of financial risk and may increase the exposure of the Fund or its investments to factors such as rising interest rates, downturns in the economy or deterioration in the condition of the collateral underlying such investments. The use of leverage will increase the amount of funds available to the Fund for investment, but will also increase the risk of loss.

- The Fund intends to develop, construct and renovate properties. The development, construction and renovation of real estate assets is subject to timing, budgeting, cost and other risks that may adversely affect the Fund’s operating results. The Fund may abandon development activities after expending resources to determine their feasibility; occupancy rates and rents at a newly completed property may not be sufficient to make the property profitable; financing may not be available on favorable terms for development of a property; and the construction and development of a property may not be completed on schedule (resulting in increased debt service and construction costs).

- An investment in the Fund will be illiquid, as there is no secondary market for the Fund’s interests and none is expected to develop; and there will be substantial restrictions on transferring such interests. Accordingly, an investor may be required to maintain its interest in the Fund for an indefinite period of time.

- The Fund depends on our Sponsor to conduct our operations. The Fund will pay fees and expenses to our Sponsor and its affiliates that were not determined on an arm’s length basis, and therefore the Fund does not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties. These fees increase your risk of loss.

- The Fund has a limited operating history. The prior performance of our Sponsor and its affiliated entities may not predict the Fund’s future results. Therefore, there is no assurance that the Fund will achieve its investment objectives.