S2K/Miller CLT Fund

5.3 acre site in Charlotte, NC developing 500 Class A market rate multifamily units.

S2K/Miller CLT Fund

5.3 acre site in Charlotte, NC developing 500 Class A market rate multifamily units.

Project Overview

in Rapidly Growing Market

The S2K/Miller CLT Fund (“Fund”) is acquiring a 5.3-acre site in Charlotte, NC and is partnering with Abacus Capital, an experienced local developer to develop approximately 500 Class A market rate multifamily units. The site is currently undergoing predevelopment and planning which is anticipated to yield a project that will encompass significant multifamily housing density and complimentary retail uses.

- Steps away from the Sugar Creek stop of the Lynx Blue Line, Charlotte's new commuter light rail.

- To meet growing demand, Charlotte must add 4,000 new apartment homes every year.

- Charlotte job market expected to grow 50% by 2050, one of the fastest job and population growth metropolitan areas.

Potential building renderings. Designs may change.

- Location: 4109 Greensboro St, Charlotte

- Property type: Multifamily & Mixed Use

- Construction type: Mid-Rise

- Units: 500

- Site: 5.3 Acres

- Construction Start: Q1/Q2 2026

#1 Best State for Business, #1 Housing Market

Development of 500 Multifamily Units

The Fund is acquiring 90% interest in a 5.3-acre property in a fast-growing submarket of Charlotte that will be developed into a multifamily apartment building and retail space

Highly Desirable Location

- Fully entitled line with most flexible TOD-CC zoning designation

- 5-minute walk from northern light rail spur

- 17 minutes from Charlotte Douglas International Airport

- 12 minutes from UNC Charlotte

- 10 minutes from central business district

- NoDa submarket projects highest overall household and income growth rates through 2027

- Site part of NC Brownfield Program

One of the Fastest Growing Cities

For every person who moved out of Charlotte, nearly 1.5 people moved in1, and over 120 people are moving to Charlotte per day2.

Charlotte is home to six Fortune 500 companies and has become one of the most attractive relocation spots for individuals and companies alike.

1) NBC-affiliated WCNC 2) FOX46 Charlotte

Charlotte Economic and Job Growth Is in the News

- #1 Best State for Business (CNBC 2023)

- #1 Housing Market 2023 (Zillow)

- #2 US Metro Area YOY Job Growth (GUSTO 2022)

- #7 Fastest Growing Metro (2023 State of Center City Report)

- Top 10 Market for RE Prospects (ULI & PWC 5th consecutive year, Emerging Trends in Real Estate)

- #9 in the World for Fintech Startup Ecosystem (Global Startup Ecosystem Report, Fintech Edition)

- Total GDP Up 58% (US Census Bureau)

- Total Population Up 17% (US Census Bureau)

- Total Employment Up 22% (US Census Bureau)

- Total Housing Permits Up 334% (US Census Bureau)

- Total Compensation Up 58% (US Census Bureau)

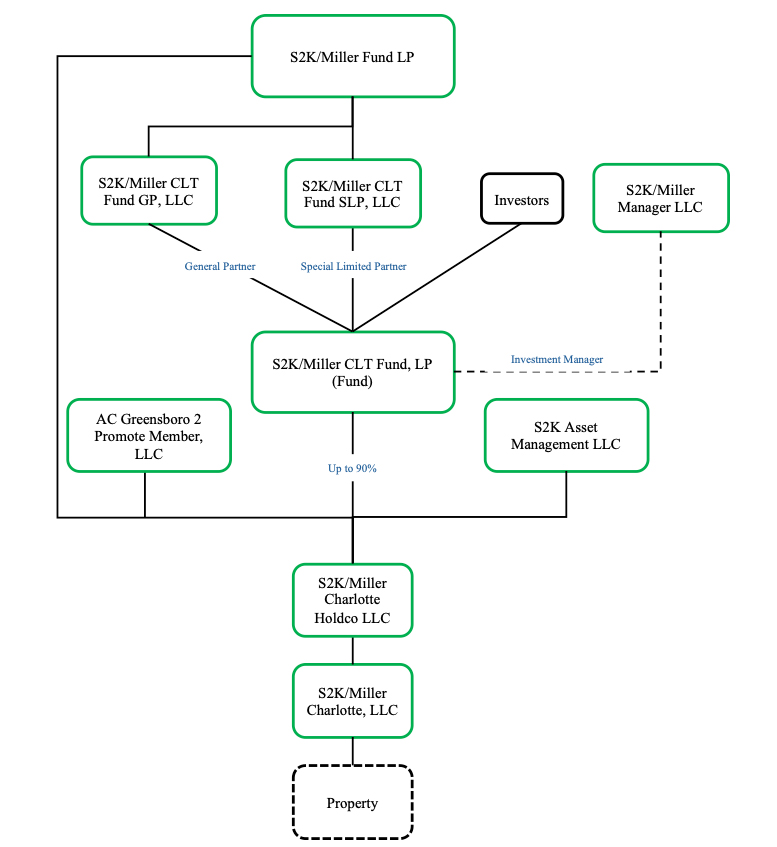

Structure

S2K/Miller Fund LP (the “S2K/Miller Fund”), S2K Asset Management LLC (“S2K”) and AC Greensboro 2 Promote Member, LLC (“Abacus”) currently own the 10.1-acre property (“Property”) through S2K/Miller Charlotte Holdco (“Holdco”) and intend to subdivide the Original Property into two parcels.

The Fund will use proceeds from Fund Investors to purchase up to 90% of Holdco from the S2K/Miller Fund and S2K. An affiliate of Abacus will be the development partner and will be responsible for raising both institutional LP capital and sourcing the construction lender to fund the vertical construction of a mixed-use multifamily development on the newly subdivided property.

The Fund intends to use the proceeds from the offering for the following:

Purchase up to a 90% interest in Holdco from the S2K/Miller Fund and S2K Asset Management

Extinguish current debt on the Property

Contribute its pro rata share of the expenses to complete horizontal development including developing roads and establishing utilities

Contribute its pro rata share of other soft costs including engaging civil engineers and architects for predevelopment

Pay commissions, marketing expenses, and other costs related to the offering

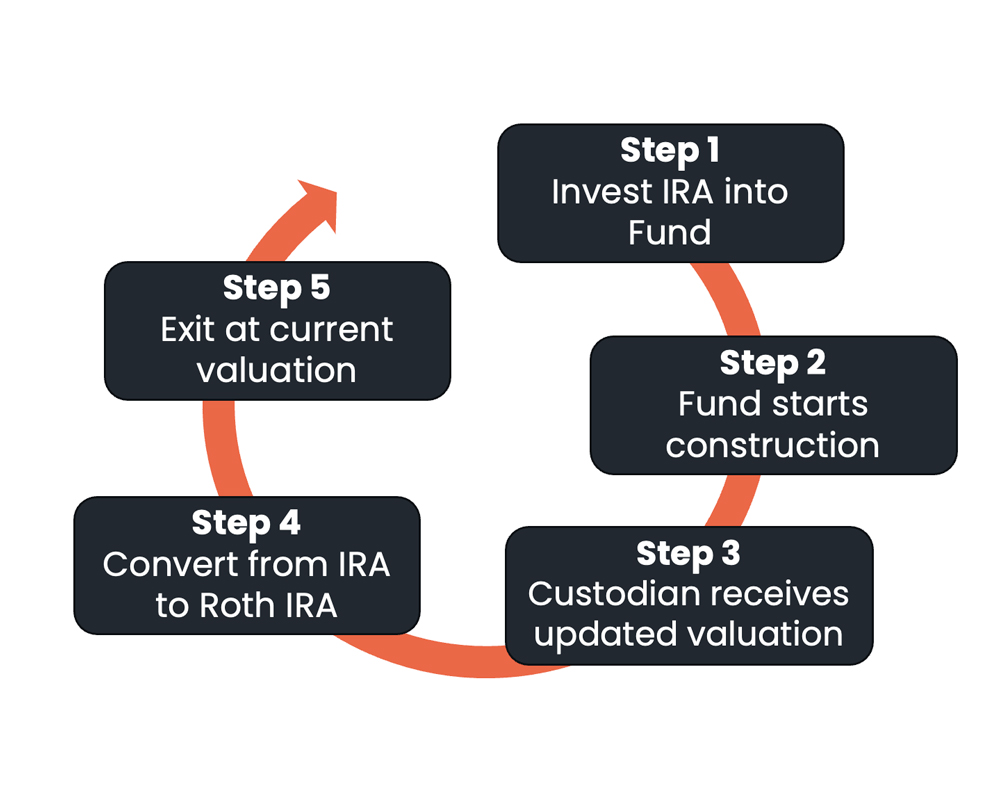

Step 1: Investors use their traditional IRA to invest into this type of fund.

Step 2: Construction starts and a third party prepares a report assessing the reduction in value.

Step 3: The IRA custodian receives the third-party report. Investors are notified of this reduction in value.

Step 4: The investor initiates an IRA to Roth IRA conversion at the reduced valuation. This will create a taxable event for the investor that may include additional penalties and fees.

Step 5: Construction of the development project is completed; the project is leased and reaches stabilization. Typically, developers anticipate that at this stage of a project the net asset value will be higher than the initial capital invested into the fund. The project is then sold, and distributions are made to the investors.1

1) Distributions are not guaranteed and may include return of principal, and in such cases, the fund will have less money to invest, which may lower its overall return.

FAQ

There is no secondary market for the Fund's interests and none is expected to develop. There will be substantial restrictions on transferring such interests. Accordingly, an investor may be required to maintain its interest in the Fund for an indefinite period of time.

- The Fund’s organization documents permit the Fund to pay distributions from any source, including cash flow from operations, offering proceeds, borrowings, or sales of assets. Until the proceeds from the offering are fully invested and from time to time during the operational stage, the Fund may not generate sufficient cash flow from operations to fund distributions. If the Fund pays distributions from financings, the net proceeds from this or future offerings or other sources other than our cash flow from operations, the Fund will have less funds available for investments and the overall return to the Fund’s investors may be reduced. If distributions are funded from borrowings, the Fund’s interest expense and other financing costs, as well as the repayment of such borrowings, will reduce earnings and cash flow from operations available for distribution in future periods, and accordingly your overall return may be reduced.

Accedited investors only. Please visit our investor portal to apply and learn more.

4109 Greensboro St, Charlotte

- Club Room

- Courtyard Pool & Cabana Facilities

- Fitness Center

- Sky Lounge

These amenities may change as development work is still in process.

- Developer: S2K/Abacus

- GC: TBD

- Architect: BB+M

- Civil Engineer: ColeJenest & Stone, Bolton & Menk

Investing in the Fund is highly speculative and involves a high degree of risk. You should purchase these interests only if you can afford a complete loss of your investment. See the section entitled “Certain Risk Factors” of the Fund’s private placement memorandum (“PPM”) to read about the more significant risks you should consider before investing. These risks include the following:

- It is expected that the Funds investment in the property will be illiquid or for which a secondary market is not readily available. Such illiquidity may limit the Fund’s ability to modify its portfolio in response to changes in economic or other conditions.

- The Fund intends to obtain additional equity capital from other limited partners for the development of the property and may not be successful. Many variables exist regarding the ability to consummate a transaction with such limited partners. As a result, the Fund may experience longer times than expected to raise capital which may extend the time the property is owned, which may reduce the expected return to the Fund.

- The acquisition, re-habilitation, renovation and development of the property may be financed in substantial part by debt, which will increase the Fund’s exposure to loss. The use of leverage involves a high degree of financial risk and may increase the exposure of the Fund or the property to factors such as rising interest rates, downturns in the economy or deterioration in the condition of the property. The use of leverage will increase the amount of funds available to the Fund for investment, but will also increase the risk of loss.

- The Fund intends to develop, construct and renovate the property. The development, construction and renovation of the property is subject to timing, budgeting, cost and other risks that may adversely affect the Fund’s operating results. The Fund may abandon development activities after expending resources to determine their feasibility; occupancy rates and rents at a newly completed property may not be sufficient to make the property profitable; financing may not be available on favorable terms for development of the property; and the construction and development of the property may not be completed on schedule (resulting in increased debt service and construction costs).

- An investment in the Fund will be illiquid, as there is no secondary market for the Fund’s interests and none is expected to develop; and there will be substantial restrictions on transferring such interests. Accordingly, an investor may be required to maintain its interest in the Fund for an indefinite period of time.

- The Fund depends on our Sponsor to conduct our operations. The Fund will pay fees and expenses to our Sponsor and its affiliates that were not determined on an arm’s length basis, and therefore the Fund does not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties. These fees increase your risk of loss.

- The Fund has a limited operating history. The prior performance of our Sponsor and its affiliated entities may not predict the Fund’s future results. Therefore, there is no assurance that the Fund will achieve its investment objectives.

Terms

Limited Partner Units

S2K/Miller CLT Fund, LP

$21,000,000

Multifamily development located in Charlotte NC

Currently ~$6,300,000 and expected to be $1,500,000 at offering completion1

1: Sponsor currently has $12,000,000 invested in the overall 10.1 acre parcel, but is expected to have $6,300,000 invested in the subject parcel and $5,700,000 in the adjacent parcel upon splitting the parcels.

Accredited Investors Only

$100,000

K-1

Vistra USA LLC

Forvis Mazars LLP

Alston & Bird

Important Information

These materials (the “Materials”) and the information contained herein are strictly confidential and are being provided to you in a one-on-one presentation for informational and discussion purposes only. By acceptance of the Materials you agree to keep them confidential and not to disclose them to anyone except (i) to your legal, tax and financial advisors who agree to maintain the Materials in confidence or (ii) to a government official upon request, if entitled to such information pursuant to a judicial or governmental order.

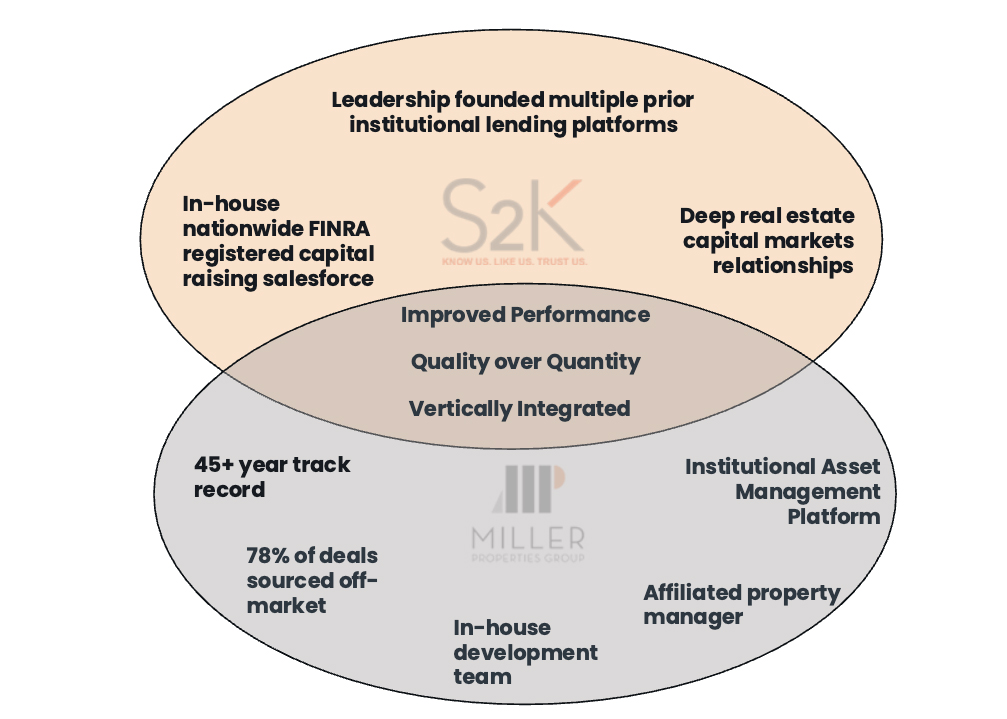

Except as otherwise noted, the term “Manager" as used throughout this presentation refers collectively to Miller Properties Group and its affiliates (collectively, “Miller”) and S2K Asset Management and its affiliates (collectively, “S2K”, and together with Miller, “S2K/Miller”).

The Materials should not be photocopied, reproduced or delivered to any person without the prior permission of the Manager. Investors should not construe the contents of the Materials as legal, tax, accounting, investment or other advice. Each investor should make its own inquiries and consult its advisors as to legal, tax, financial, and other relevant matters concerning any investment, including an investment in the S2K/Miller CLT Fund LP, a Delaware limited partnership (the “Fund”). The indicative terms and other information included in the Materials are incomplete, subject to change and are provided for discussion purposes only. Please refer to the Offering Memorandum of the Fund for a detailed description of the terms of the Fund.

S2K Financial LLC (“S2K Financial”), an affiliate of S2K, will serve as Placement Agent for the Fund. As Placement Agent, S2K Financial may receive selling commissions of up to 7.0% of the gross sales proceeds from investors that invest through participating broker-dealers, 100% of which will be reallowed by S2K Financial to participating broker-dealers. S2K Financial may also receive a placement agent fee equal to 3.0% of the gross sales proceeds from investors that invest through participating broker-dealers, registered investment advisors or family offices, all or a portion of which may be reallowed by S2K Financial to participating broker-dealers.

The Materials are not an offer to sell a security nor the solicitation of an offer to buy a security and no offer or solicitation should be implied by the delivery of the Materials. The Materials and related information about the Fund cannot be used in conjunction with the marketing of any product or security. Recipients should not rely on the Materials in making any future investment decision. Statements contained in the Materials are based on current expectations, estimates, targets, projections, opinions and beliefs of the Manager. Such statements involve known and unknown risks, uncertainties and other factors. These and other forward-looking statements contained in the Materials are speculative in nature, involve a number of assumptions which may not prove to be valid, and may be changed without notice. “Forward-looking statements” can be identified by the use of forward-looking terminology such as “may,” “will,” “seek,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” “target,” “plan” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements. No reliance may be placed for any purpose whatsoever on the information, representations or opinions contained in the Materials, and no liability is accepted for any such information, representations or opinions, nor does the Manager or any other person, to the maximum extent permitted by law, accept any responsibility or liability whatsoever for any direct or indirect loss howsoever arising from the use of the Materials.

Statements in the Materials are made as of February 2025, unless otherwise stated herein, and the delivery of the Materials shall not at any time under any circumstances create an implication that the information contained herein is correct as of any time subsequent to such date. The Manager does not have any obligation to update or revise any statement in the Materials or correct inaccuracies whether as a result of new information, future events or otherwise. The information contained herein has not been audited, contains approximates and has no bearing on the future performance of the Fund.

Performance Information. In considering any target, projected or historical performance information contained herein, prospective investors should bear in mind that such information is not necessarily indicative of future results. While the targeted or projected returns are based on assumptions regarding estimates of underlying cash flows, current business plans, timing, financing terms and residual values for the investments which the Manager believes are reasonable, there can be no assurance that such results will actually be realized or that capital contributed by investors will be returned. Actual gross and net returns for the Fund, and individual investors participating directly or indirectly in the Fund, may vary significantly from any targeted, projected or historical returns set forth herein and will depend on, among other factors, the ability to consummate attractive investments, future operating results, the availability and terms of financing, the value of the assets and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the assumptions on which the targeted or projected returns are based. Past performance of the Fund and other accounts managed by Miller, S2K, and their respective principals is no guarantee, and may not be indicative, of future results.

Information regarding expected market returns and market outlooks is based on research, analysis, and opinions of certain members of the Manager. These conclusions are speculative in nature, may not come to pass, and are not intended to predict the future of any specific investment. Certain factual economic and market information contained herein has been obtained from published sources prepared by other parties and has not been independently verified by the Manager. While such sources are believed to be reliable, the Manager does not assume any responsibility for the accuracy or completeness of such information.

Images contained herein are for illustrative purposes only.

SECURITIES OFFERED THROUGH S2K FINANCIAL LLC, MEMBER FINRA/SIPC, THE DEALER MANAGER FOR S2K/MILLER CLT FUND, LP

Risk Factors

Investing in the Fund is highly speculative and involves a high degree of risk. You should purchase these interests only if you can afford a complete loss of your investment. See the section entitled “Certain Risk Factors” of the Fund’s private placement memorandum (“PPM”) to read about the more significant risks you should consider before investing. These risks include the following:

- It is expected that the Funds investment in the property will be illiquid or for which a secondary market is not readily available. Such illiquidity may limit the Fund’s ability to modify its portfolio in response to changes in economic or other conditions.

- The Fund intends to obtain additional equity capital from other limited partners for the development of the property and may not be successful. Many variables exist regarding the ability to consummate a transaction with such limited partners. As a result, the Fund may experience longer times than expected to raise capital which may extend the time the property is owned, which may reduce the expected return to the Fund.

- The acquisition, re-habilitation, renovation and development of the property may be financed in substantial part by debt, which will increase the Fund’s exposure to loss. The use of leverage involves a high degree of financial risk and may increase the exposure of the Fund or the property to factors such as rising interest rates, downturns in the economy or deterioration in the condition of the property. The use of leverage will increase the amount of funds available to the Fund for investment, but will also increase the risk of loss.

- The Fund intends to develop, construct and renovate the property. The development, construction and renovation of the property is subject to timing, budgeting, cost and other risks that may adversely affect the Fund’s operating results. The Fund may abandon development activities after expending resources to determine their feasibility; occupancy rates and rents at a newly completed property may not be sufficient to make the property profitable; financing may not be available on favorable terms for development of the property; and the construction and development of the property may not be completed on schedule (resulting in increased debt service and construction costs).

- An investment in the Fund will be illiquid, as there is no secondary market for the Fund’s interests and none is expected to develop; and there will be substantial restrictions on transferring such interests. Accordingly, an investor may be required to maintain its interest in the Fund for an indefinite period of time.

- The Fund depends on our Sponsor to conduct our operations. The Fund will pay fees and expenses to our Sponsor and its affiliates that were not determined on an arm’s length basis, and therefore the Fund does not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties. These fees increase your risk of loss.

- The Fund has a limited operating history. The prior performance of our Sponsor and its affiliated entities may not predict the Fund’s future results. Therefore, there is no assurance that the Fund will achieve its investment objectives.