S2K Charlotte Multifamily OZ Fund

350-unit multifamily opportunity zone development in the heart of Charlotte's high-growth NoDa district.

Charlotte OZ Fund

350-unit multifamily opportunity zone development in the heart of Charlotte's high-growth NoDa district.

Investment Overview

in Rapidly Growing Market

The fund acquired an 8-acre opportunity zone-eligible site in Charlotte, NC , and is in the process of developing 350 Class A market-rate multifamily units, with the ability to develop or co-develop additional residential units and complementary mixed-use components.

- Steps away from the Sugar Creek stop of the Lynx Blue Line, Charlotte's new commuter light rail.

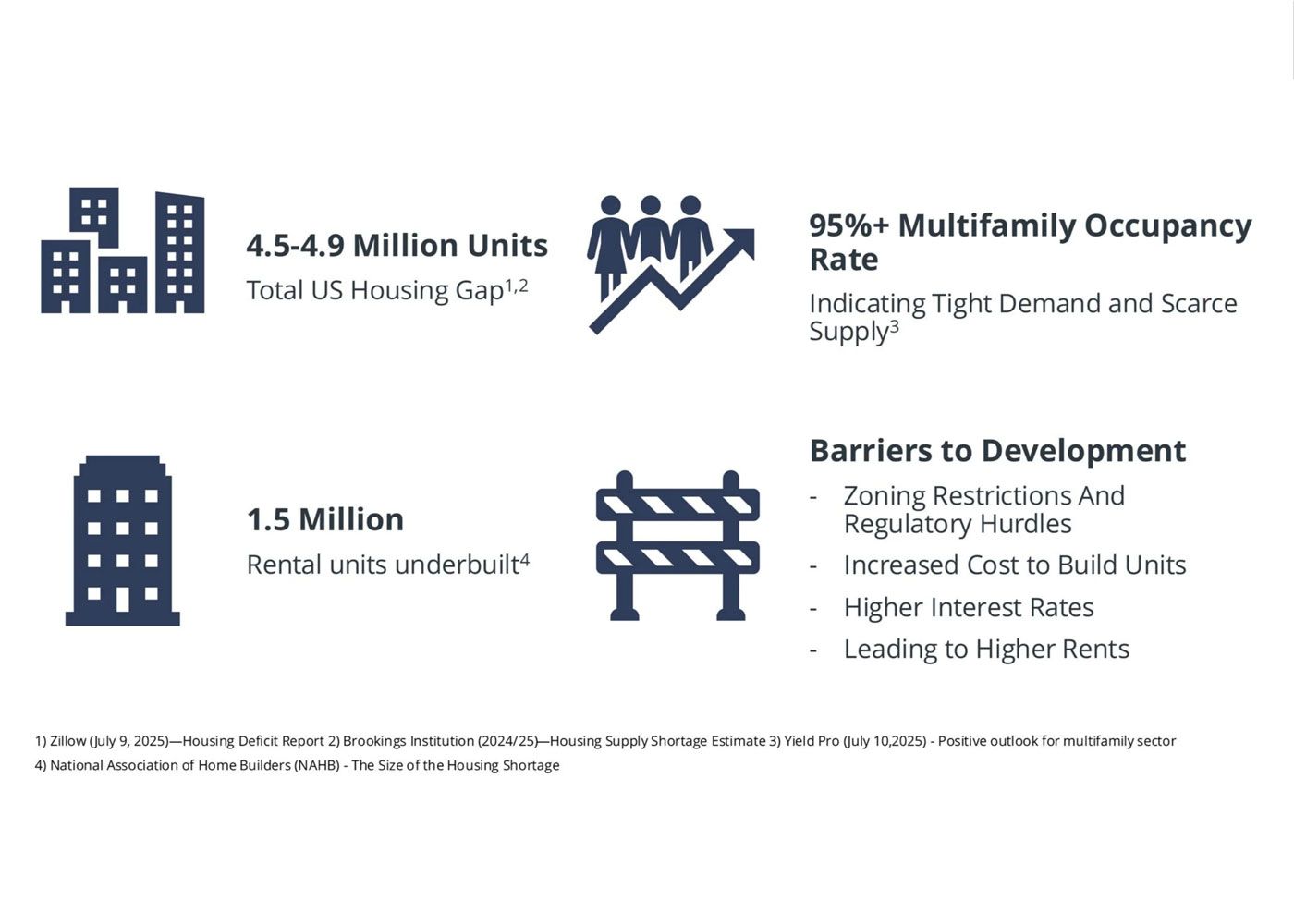

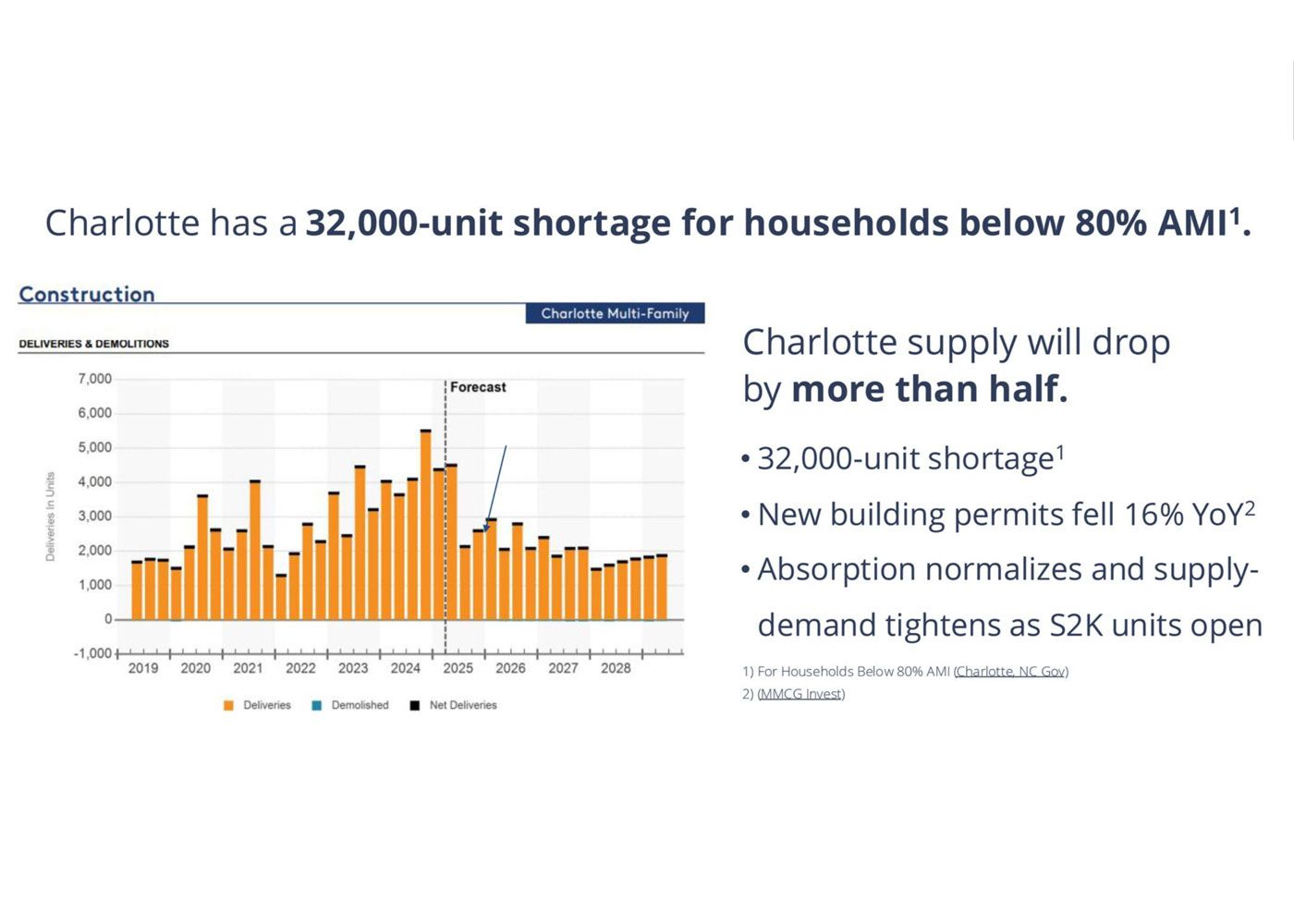

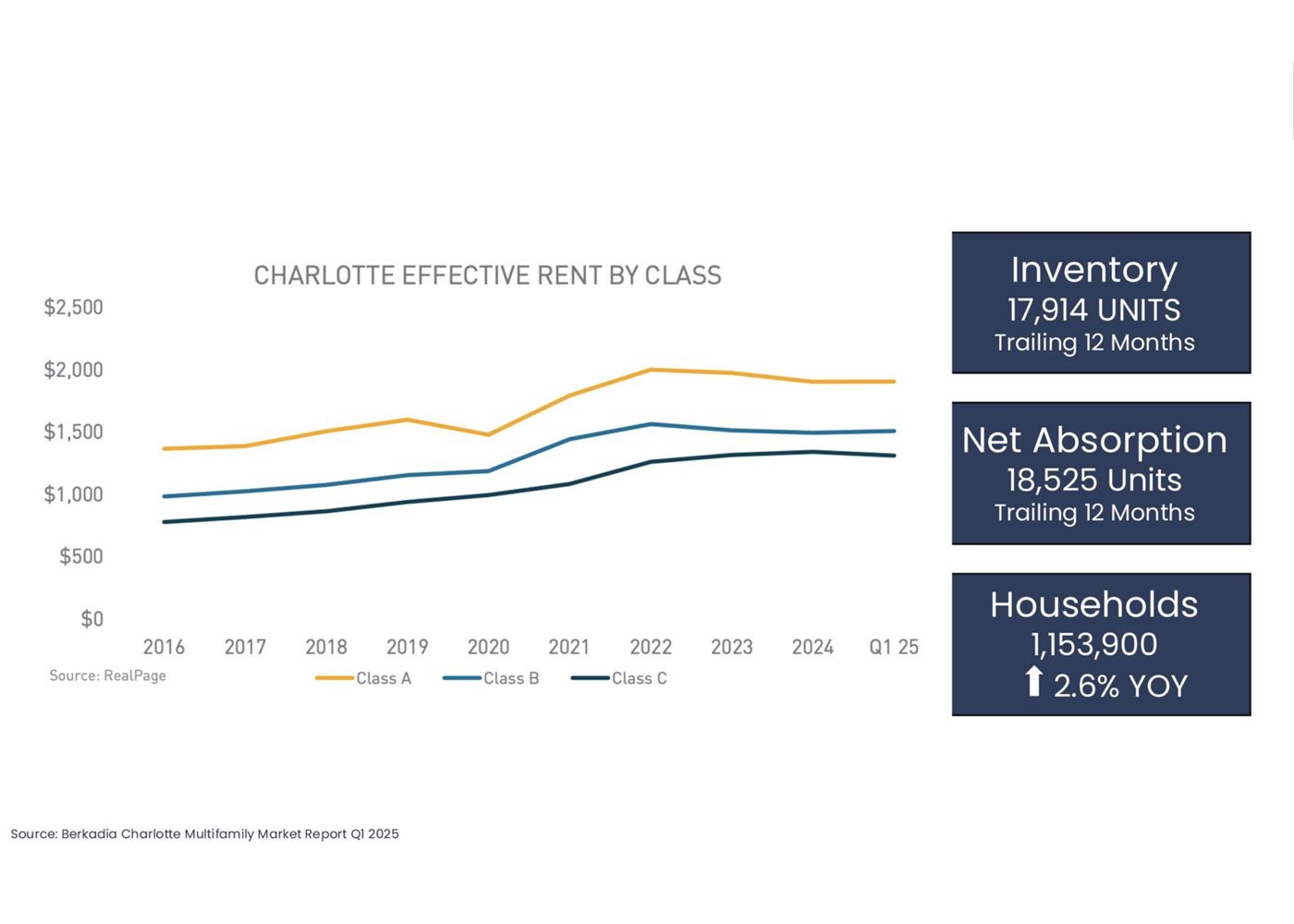

- To meet growing demand, Charlotte must add 4,000 new apartment homes every year.

- Charlotte job market expected to grow 50% by 2050, one of the fastest job and population growth metropolitan areas.

Rendering of first phase of project. Designs may change.

- Location: 4101 Greensboro St, Charlotte

- Property type: Multifamily

- Construction type: Midrise

- Units: 350

- Site: 8 Acres

- Construction Start: Q3/Q4 2024

- Developer: S2K/Caprock/Abacus

- GC: C. Herman Construction

- Architect: BB+M

- Civil Engineer: ColeJenest & Stone, Bolton & Menk

#1 Best State for Business, #1 Housing Market

Development of 350 Multifamily Units

The Fund acquired an eight (8) acre opportunity zone eligible site and is developing 350 Class A market rate multifamily units, with options to develop or co-develop additional residential and mixed-use components.

The Sponsor plans to develop approximately 750 residential units, however, the initial number of residential units is expected to be 350.

Highly Desirable Location

- Fully entitled line with most flexible TOD-CC zoning designation

- 5-minute walk from northern light rail spur

- 17 minutes from Charlotte Douglas International Airport

- 12 minutes from UNC Charlotte

- 10 minutes from central business district

- NoDa submarket projects highest overall household and income growth rates through 2027

- Site part of NC Brownfield Program

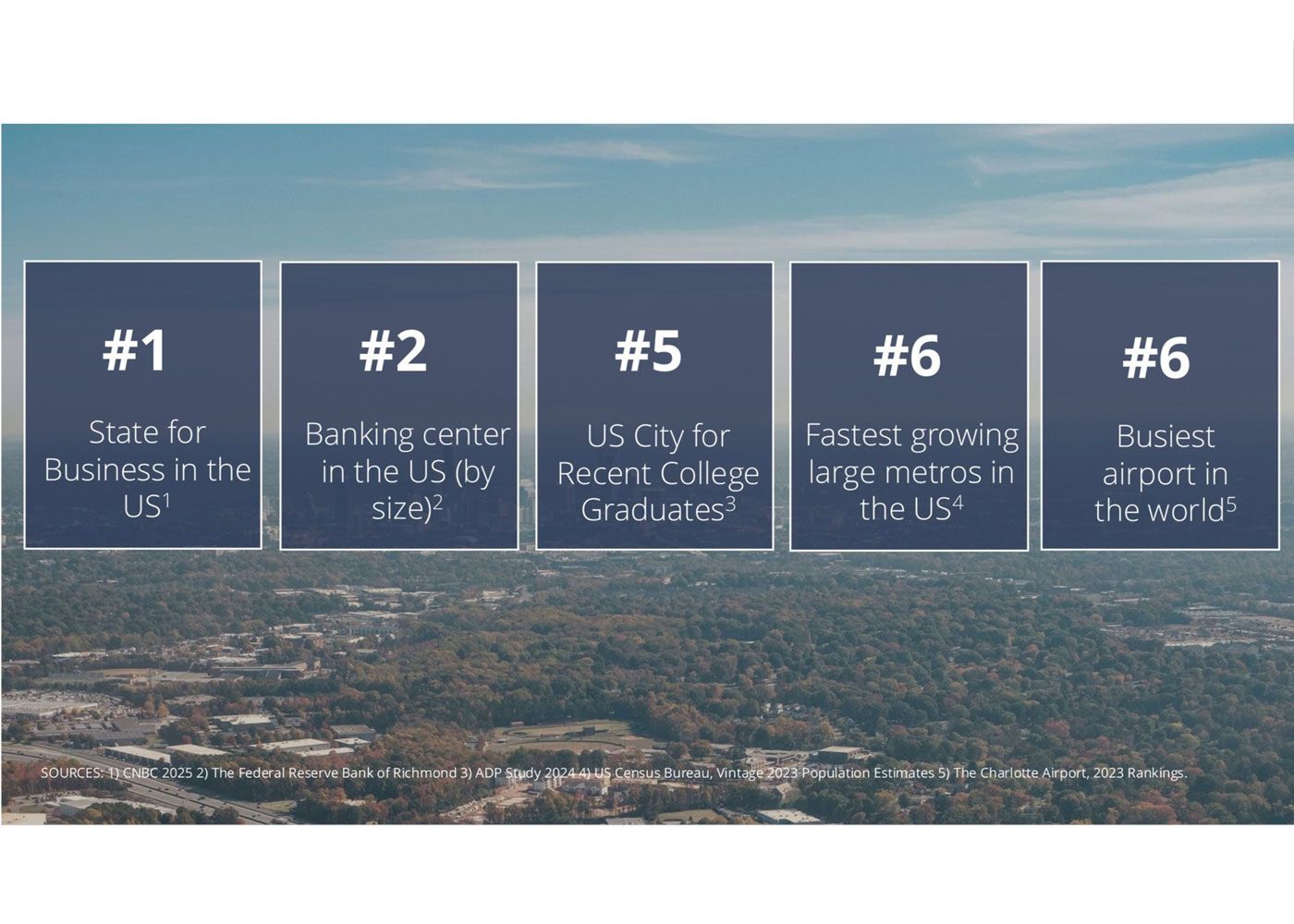

One of the Fastest Growing Cities

For every person who moved out of Charlotte, nearly 1.5 people moved in1, and over 120 people are moving to Charlotte per day2.

Charlotte is home to six Fortune 500 companies and has become one of the most attractive relocation spots for individuals and companies alike.

1) NBC-affiliated WCNC 2) FOX46 Charlotte

Charlotte Economic and Job Growth Is in the News

- #1 Best State for Business (CNBC 2023)

- #1 Housing Market 2023 (Zillow)

- #2 US Metro Area YOY Job Growth (GUSTO 2022)

- #7 Fastest Growing Metro (2023 State of Center City Report)

- Top 10 Market for RE Prospects (ULI & PWC 5th consecutive year, Emerging Trends in Real Estate)

- #9 in the World for Fintech Startup Ecosystem (Global Startup Ecosystem Report, Fintech Edition)

- Total GDP Up 58% (US Census Bureau)

- Total Population Up 17% (US Census Bureau)

- Total Employment Up 22% (US Census Bureau)

- Total Housing Permits Up 334% (US Census Bureau)

- Total Compensation Up 58% (US Census Bureau)

CapRock, LLC is a vertically integrated, full-service real estate development company located in Charlotte, North Carolina. CapRock specializes in financing, design and construction for a variety of property types primarily with a focus on multifamily, senior living, and townhomes. The Principals of CapRock bring more than 80 years of combined experience in investment banking, capital markets, development and construction of industrial, retail, office, and hospitality projects.

Abacus Capital, LLC is a local Charlotte-based real estate investment firm focused on the opportunistic acquisition and development of differentiated commercial real estate assets in growth markets across the Southeast. Abacus is active in the Charlotte market.

Abacus has invested $2.5 million into the project.

FAQ

There is no secondary market for the Fund's interests and none is expected to develop. There will be substantial restrictions on transferring such interests. Accordingly, an investor may be required to maintain its interest in the Fund for an indefinite period of time.

- The Fund’s organization documents permit the Fund to pay distributions from any source, including cash flow from operations, offering proceeds, borrowings, or sales of assets. Until the proceeds from the offering are fully invested and from time to time during the operational stage, the Fund may not generate sufficient cash flow from operations to fund distributions. If the Fund pays distributions from financings, the net proceeds from this or future offerings or other sources other than our cash flow from operations, the Fund will have less funds available for investments and the overall return to the Fund’s investors may be reduced. If distributions are funded from borrowings, the Fund’s interest expense and other financing costs, as well as the repayment of such borrowings, will reduce earnings and cash flow from operations available for distribution in future periods, and accordingly your overall return may be reduced.

Accedited investors only. Please visit our investor portal to apply and learn more.

All types of capital gains are eligible to invest in a Qualified Opportunity Zone including both short-term and long-term gains. Examples of eligible gains include*:

- Sale of Stock

- Sale of Business

- Sale of Real Estate

- Cryptocurrency

- Sale of Bonds

- No federal taxes on fund profit after 10 years3.

Sale of any appreciated assets that trigger a capital gains tax may qualify to invest in a QOZ.

4101 Greensboro St, Charlotte

- Club Room

- Courtyard Pool & Cabana Facilities

- Fitness Center

- Sky Lounge

These amenities may change as development work is still in process.

- Developer: S2K/Caprock/Abacus

- GC: C. Herman Construction

- Architect: BB+M

- Civil Engineer: ColeJenest & Stone, Bolton & Menk

Investing the Fund’s common units is speculative and involves substantial risks. You should purchase these interests only if you can afford a complete loss of your investment. See the section entitled “Risk Factors” of the Fund’s PPM to read about the more significant risks you should consider before buying our common units. These risks include the following:

- This Initial Offering is being made to allow investors to take advantage of recently adopted rules and regulations under the Tax Cuts and Jobs Act (“TCJA”). The legal and compliance requirements of this legislation, including with regard to Opportunity Funds like the Fund’s, is relatively untested.

- An investment in the Fund will be illiquid, as there is no secondary market for the Fund’s interests and none is expected to develop; and there will be substantial restrictions on transferring such interests. Accordingly, an investor may be required to maintain its interest in the Fund for an indefinite period of time. The property to be acquired by the Fund is subject to leverage and its investment performance may be volatile. Investors should have the financial ability and willingness to accept the risk characteristics of the Fund.

- If the Fund fails to qualify as an Opportunity Fund for U.S. federal income tax purposes for any period and no relief provisions apply, the Fund would be subject to penalties which could be significant. As a result, returns to investors could be materially reduced.

- The Fund depends on our Sponsor to conduct our operations. The Fund will pay fees and expenses to our Sponsor and its affiliates that were not determined on an arm’s length basis, and therefore the Fund does not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties. These fees increase your risk of loss.

- The Fund has a limited operating history. The prior performance of our Sponsor and its affiliated entities may not predict the Fund’s future results. Therefore, there is no assurance that the Fund will achieve its investment objectives.

- The Fund’s Sponsor may in the future sponsor other companies that compete with the Fund, and the Sponsor does not have an exclusive management arrangement with the Fund.

Terms

LLC Interests

$55,000,000

Multifamily development located in Charlotte, North Carolina

$8,000,000

1Affiliates of the Sponsor invested $8,000,000 into a subsidiary of the Fund

$100,000

Each Member shall pay to the Investment Adviser a fee (the “Asset Management Fee”) in an amount equal to (i) one and one half percent (1.50%) per annum of the Member’s Capital Contributions until such Member has received cumulative distributions pursuant to the Operating Agreement equal to sixty percent (60%) of such Member’s aggregate Capital Contributions and (ii) thereafter one percent (1%) per annum of the aggregate of Fair Market Value of the Property determined in accordance with the Operating Agreement. The Asset Management Fee will be payable monthly in advance.

K-1

Phoenix America

Mazars US LLP

Nelson Mullins

Important Information

THIS PRESENTATION IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY SECURITIES. THE OFFERING AND SALE OF INTERESTS IN S2K CHARLOTTE MULTIFAMILY OZ FUND LLC (“THE FUND”) IS BEING MADE ONLY BY DELIVERY OF THE FUND’S PRIVATE PLACEMENT MEMORANDUM (“PPM”), CERTAIN ORGANIZATIONAL DOCUMENTS, SUBSCRIPTION AGREEMENT AND CERTAIN OTHER INFORMATION TO BE MADE AVAILABLE TO INVESTORS (“OPERATIVE DOCUMENTS”) BY THE FUND’S SPONSOR.

This material must be read in conjunction with the Operative Documents in order to fully understand all of the implications and risks of the offering of securities to which the Operative Documents relate. Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of the Fund’s interests, determined if the Operative Documents are truthful or complete or passed on or endorsed the merits of the offering. Any representation to the contrary is a criminal offense. You may only invest in the Fund if you are an accredited investor as defined in Rule 501 of Regulation D.

Investing in the Fund will involve significant risks, including possible loss of your entire investment. An investment in the Fund will be illiquid, as there is no secondary market for the Fund’s interests and none is expected to develop; and there will be substantial restrictions on transferring such interests. Accordingly, an investor may be required to maintain its interest in the Fund for an indefinite period of time. The interest in the real property to be acquired by the Fund is subject to leverage and its investment performance may be volatile. Investors should have the financial ability and willingness to accept the risk characteristics of the Fund.

Prospective investors should make their own investigations and evaluations of the information contained in this presentation and the other Operative Documents. Each prospective investor should consult its own attorneys, business advisors and tax advisors as to legal, business, tax and related matters concerning the information contained herein. This presentation does not take into account the particular investment objectives or financial circumstances of any specific person who may receive it. An investment in the Fund is not suitable for all investors.

This presentation contains forward-looking statements within the meaning of federal securities laws and regulations relating to the business and financial outlook of the Fund that are based on management’s current expectations, estimates, forecasts and projections and are not guarantees of future performance. These forward-looking statements are identified by the use of terms and phrases such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will” and other similar terms and phrases, including references to assumptions and forecasts of future results. Actual results may differ materially from those expressed in these forward-looking statements. You should not place undue reliance on any such statements. A number of important factors could cause actual results to differ materially from the forward-looking statements contained in this presentation. Forward-looking statements in this material speak only as of the date on which such statements were made and not as of any future date, and the Fund undertakes no obligation to update any such statements that may become untrue because of subsequent events.

SECURITIES OFFERED THROUGH S2K FINANCIAL LLC, MEMBER FINRA/SIPC, THE DEALER MANAGER FOR S2K CHARLOTTE MULTIFAMILY OZ FUND LLC

Risk Factors

Investing the Fund’s common units is speculative and involves substantial risks. You should purchase these interests only if you can afford a complete loss of your investment. See the section entitled “Risk Factors” of the Fund’s PPM to read about the more significant risks you should consider before buying our common units. These risks include the following:

• This Initial Offering is being made to allow investors to take advantage of recently adopted rules and regulations under the Tax Cuts and Jobs Act (“TCJA”). The legal and compliance requirements of this legislation, including with regard to Opportunity Funds like the Fund’s, is relatively untested.

• An investment in the Fund will be illiquid, as there is no secondary market for the Fund’s interests and none is expected to develop; and there will be substantial restrictions on transferring such interests. Accordingly, an investor may be required to maintain its interest in the Fund for an indefinite period of time. The property to be acquired by the Fund is subject to leverage and its investment performance may be volatile. Investors should have the financial ability and willingness to accept the risk characteristics of the Fund.

• If the Fund fails to qualify as an Opportunity Fund for U.S. federal income tax purposes for any period and no relief provisions apply, the Fund would be subject to penalties which could be significant. As a result, returns to investors could be materially reduced.

• The Fund depends on our Sponsor to conduct our operations. The Fund will pay fees and expenses to our Sponsor and its affiliates that were not determined on an arm’s length basis, and therefore the Fund does not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties. These fees increase your risk of loss.

• The Fund has a limited operating history. The prior performance of our Sponsor and its affiliated entities may not predict the Fund’s future results. Therefore, there is no assurance that the Fund will achieve its investment objectives.

• The Fund’s Sponsor may in the future sponsor other companies that compete with the Fund, and the Sponsor does not have an exclusive management arrangement with the Fund.

• The Fund’s organization documents permit the Fund to pay distributions from any source, including cash flow from operations, offering proceeds, borrowings, or sales of assets. Until the proceeds from the offering are fully invested and from time to time during the operational stage, the Fund may not generate sufficient cash flow from operations to fund distributions. If the Fund pays distributions from financings, the net proceeds from this or future offerings or other sources other than our cash flow from operations, the Fund will have less funds available for investments and the overall return to the Fund’s investors may be reduced. If distributions are funded from borrowings, the Fund’s interest expense and other financing costs, as well as the repayment of such borrowings, will reduce earnings and cash flow from operations available for distribution in future periods, and accordingly your overall return may be reduced.

• The Fund’s limited liability company agreement does not require the Sponsor to seek investors approval to liquidate the property by a specified date. No public market currently exists for the interests and you may not be able to sell your interests. If you are able to sell your interests, you may have to sell them at a substantial loss.

• The Sponsor intends for the Fund to be classified as a partnership for U.S. federal income tax purposes. As a result, it is expected that you will include your allocable share of income, deductions, gains, losses and other tax items from us on your U.S. income tax return, regardless of whether or not cash is distributed to you.

• Real estate investments, including the intended investment, in Opportunity Zones, are subject to general downturns in the industry. The Fund cannot predict what the occupancy level will be nor can the Fund predict the future value of our property. Accordingly, there is no guarantee that you will receive cash distributions or appreciation of your investment.

• The Fund is not diversified and will be substantially affected by the unfavorable performance of the property.

• The Fund’s anticipated business plan contemplates significant construction and development at the property. As a result, the investment in the property will be subject to the uncertainties associated with construction and development of real property, including the ability to complete the work in conformity with plans and specifications, budgets, and timelines.

Check Out the Neighborhood

What Is an Opportunity Zone?

An Opportunity Zone (OZ) is a designated geographic area identified by the government for economic development. OZs were established by the Tax Cuts and Jobs Act of 2017 to encourage long-term investments in low-income and rural communities nationwide. Investors can invest in these zones through Opportunity Funds.

Deferred Capital Gains Taxes

Investors can defer taxes on any prior gains invested in a Qualified Opportunity Fund (QOF) until the earlier of the date on which the investment is sold or exchanged, or December 31, 2026.

*The sponsor is not a tax advisor. Each individual's tax situation is unique. Please consult with your tax advisor to understand the specific benefits that may apply to your circumstances.

Tax Savings

If the investment in the Opportunity Fund is held for at least 10 years:

- Investors will be eligible for an increase in basis equal to the investment's fair market value on the date it is sold or exchanged, thus eliminating taxes on the related capital gains.

- Depreciation recapture is eliminated upon sale of the asset.

Economic Benefits

Bolsters Growth: Stimulates economic growth and job creation in underfunded communities by attracting long-term investments.

Versatile: Supports a wide range of investments, including real estate, infrastructure, and business development.

Social Benefits

Provides a unique opportunity for investors to positively impact economically distressed communities while potentially achieving significant tax savings.

Encourages the development of market-rate housing, improved infrastructure, and access to new businesses and services.

All types of capital gains are eligible to invest in a Qualified Opportunity Zone, including both long-and-short-term gains. Examples include:

- Sale of Stock

- Sale of Business

- Sale of Real Estate

- Cryptocurrency

- Sale of Bonds

Sale of any appreciated assets that trigger a capital gains tax may qualify to invest in a QOZ. Source: 1031 Realized